Last time, we looked at your customer “mix”, making sure that you have a balanced portfolio of clients and are not too heavily weighted with any one client. This time, we’d like to focus on:

|

As an MSP, we all spend most of our time “executing” our business strategy, and that is as it should be. However, there is value is periodically stopping to assess if the strategy is producing the results that we require (and desire). This is a chance to get a “reality check” to see if what we THINK has been happening in our business HAS been happening.

So today’s discussion is all about evaluating your “Lines of Business”. The goal is to maximize return on investment while minimizing risk. Some questions that you may want to consider in this exercise might include:

- What Line of Business is my “strategic focus”? (i.e. the business I WANT to be in).

- What Line of Business is currently driving the bulk of my Revenue and Profits?

- Considering all factors (opportunity, installed base, solutions, talent, history, reputation, etc.), what CHANGES do I need to make to better align my business to my desired area of strategic focus?

- NET RESULT: Am I truly “in” the Line of Business that I want to be in? Or does reality tell a different story?

Let’s take a look. Here’s some thoughts on how to get started:

SEGREGATE BY LINE OF BUSINESS: We’re going to look at several variables, but first we need to separate your business by “Line of Business”, and specifically, get some ideas on how to do that in ConnectWise. Here’s some suggestions by Line of Business:

- Fully Managed: Agreements in ConnectWise that are marked to “include time” and that time is marked as “unlimited”.

- Block Time: Agreements in ConnectWise that are marked to “include time” and that time is NOT marked as “unlimited”.

- Projects: Invoices that include a Project ID.

- Time-and-Materials: Service invoices that are NOT tied to an agreement that includes time, and are also NOT associated with a project.

- Traditional Hardware/Software: Invoices that are NOT service invoices and are not tied to a monthly agreement.

FACTORS TO CONSIDER FOR EACH LINE OF BUSINESS: There’s a very short list of factors to consider for each Line of Business to determine our relative success:

- Revenue: How much the client paid us.

- 3rd Party Costs: How much did we pay 3rd party vendors for hardware, software or services included as part of the solution to our end-client?

- Internal Engineering Costs: How many hours did our internal engineering team spend providing service to this client, and how much did we pay those engineers for their services?

- Net Profit: Taking the above three factors into consideration, we can determine the net profit to your firm for each Line of Business.

WHERE TO GET THE NUMBERS IN CONNECTWISE: So, where do you find these numbers in ConnectWise?

- Revenue: Look at each line item on your invoices for the amount you charged the client. My recommendation is to ignore things like sales tax and shipping, but you may or may not choose to include those items.

- 3rd Party Costs: Look at each line item on your invoices for the “cost” associated with that item. That is driven from the “Product” table in the ConnectWise setup screens.

- Internal Engineering Costs: This can get a little more involved. For invoices where you charging the client for engineering time that has already happened (like T&M invoices), then the cost entry on each invoice line item should be pretty accurate. ConnectWise records the cost for the engineers time by looking at the Member table at the time that the time entry was made, so as long as you have not made major changes to the “cost” in the Member screen for your engineers in ConnectWise, this number should be pretty accurate.For invoices where the engineering labor occurs AFTER the invoice has already been sent to the client (i.e. “Fully Managed-Flat Fee” invoices, or “Fixed Fee” Project invoices) this gets a little more difficult. You’ll need to go back to your time entries and add up the ones that were posted to Fully Managed agreements and Projects “after the invoices were already sent”. It takes a bit of doing, but if you look at Time Entries, it definitely can be done.

- Net Profit: Once your have the above three items, “Net Profit” is then just:

Revenue – 3rd Party Costs – Internal Engineering Costs

Once you have those figures, you might want to consider questions such as:

- Is the bulk of my Net Profit being derived from the Line of Business that is my “strategic focus”?

- If not, what adjustments can I make to closer align to my desired outcome?

- Do I need to:

- Better control how many hours my engineers are spending in that Line of Business?

- Look for different 3rd party products/services that may be more profitable? (or re-negotiate with my 3rd party vendors now that my business with them has grown)

- Renegotiate contracts with my clients based on the historical number of hours that you are spending servicing their contract?

So maybe it’s time to do a “reality check” on how each of your Lines of Business are performing. That way you’ll know what line of business you WANT to be in, what ones you ARE in today, and you can formulate a plan to “close the gap” if you find that one exists.

THE NEW HAVEN APPROACH

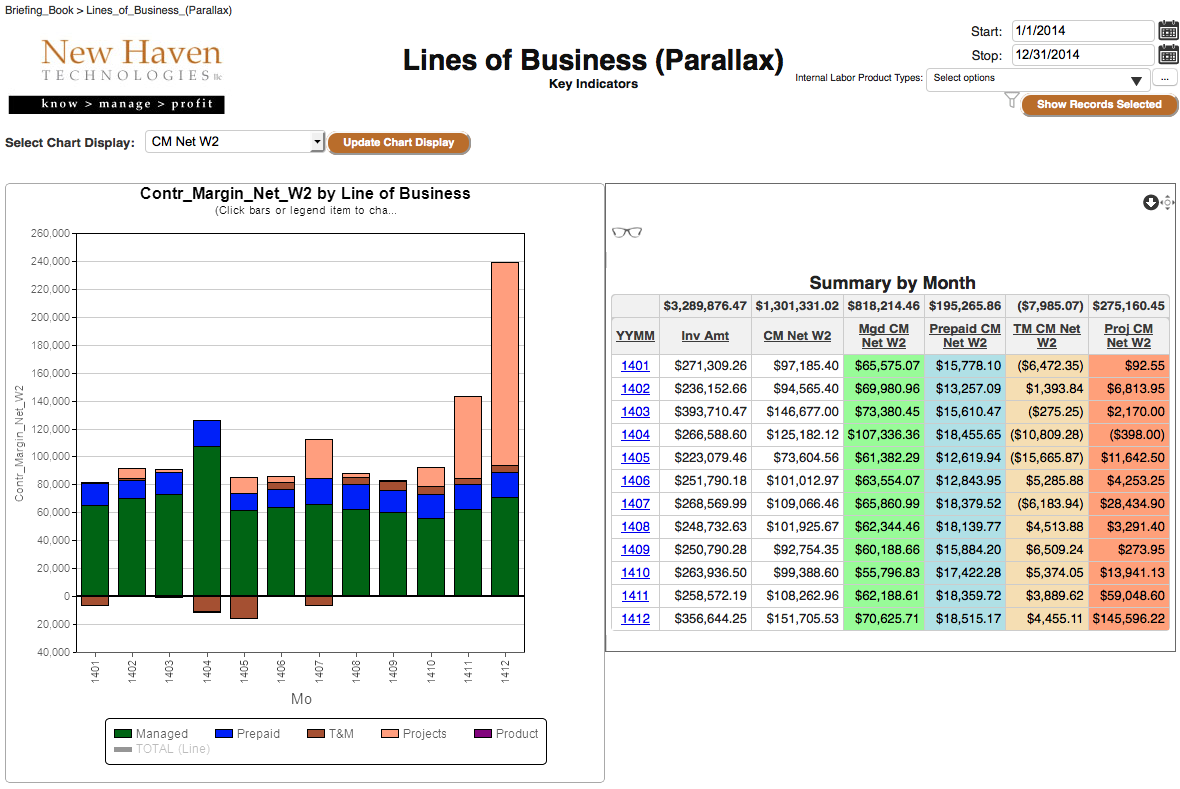

At New Haven, we tackle this exercise using our “Lines of Business (Parallax)” report. It breaks down your business by Line of Business and shows you revenue and true net profit for each. We call this a “parallax” report because it shows you the data via two “lenses”: a graphical overview AND a tabular view. Here’s a quick look:

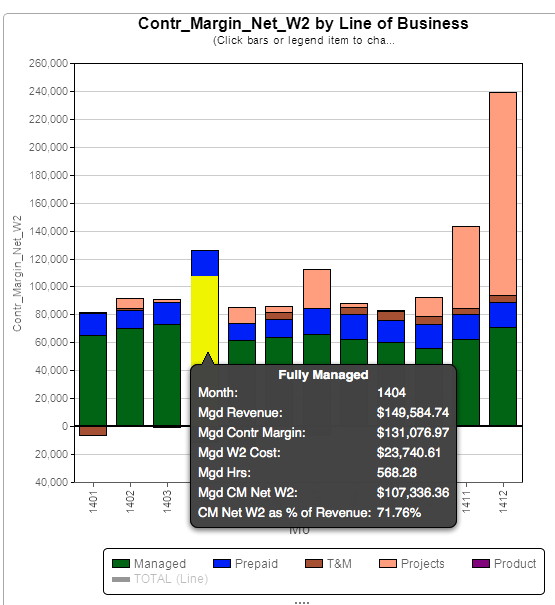

Zooming in on the chart (see below), we see that “Fully Managed” is far and away our most profitable Line of Business, even after we pay our 3rd party vendors AND our engineers. We may see some anomalies (like April) to investigate. We can get additional information about any of the graph entries by “hovering” over that part of the chart.

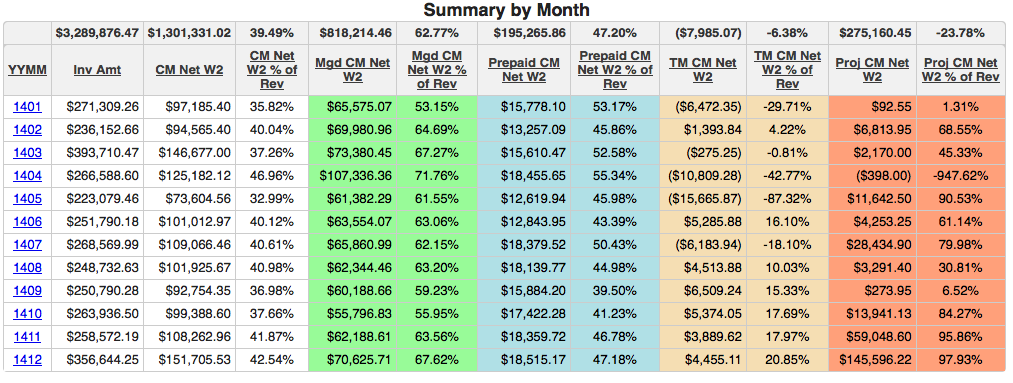

We can get more detail on any questions that we have using the parallax “table” portion of the report. For our high-level analysis today, we want to use the table to understand the “Fully Managed” Line of Business performance and how it compares to the other LOBs in the business. So let’s look look more closely at the parallax “table”:

What we see from the table is that our “Net Profit” from the Fully Managed Line of Business is $818k which is over 60% of our TOTAL Net Profit for the year. Also, we see that we are earning nearly 63 cents of net profit on every dollar of Fully Managed contract that we sell. If we see “Fully Managed” as our strategic direction, then we are making good progress in that area and earning a good return on our investment. We may even want to look at further investments in that area along with lighter investments in the other Lines of Business.

Hopefully this discussion will encourage you to take a look at the Lines of Business in your practice, looking at the return on investment from each one. Doing a “reality check” to make sure that you are progressing towards your intended goal is always a good idea.

At New Haven Technologies, we provide access to information so that you can make data-driven, informed decisions about your MSP business. Our service is provided on a month-to-month basis, and starts with a free two-week trial on your network with your data. We also include customized reporting at no additional cost as part of the service. If you are interested in learning more, just “reply” to this e-mail, or you can sign up for your free two-week trial at https://www.newhaventech.com/Trial

Best Wishes for continued success in building your MSP practice!

Dave Keller

Founder and Chief Consulting Officer

New Haven Technologies, LLC

Keller.D@NewHavenTech.com

(765) 335-KNOW

Stop Guessing. Start Knowing.

www.NewHavenTech.com